Banana Loca Shark Tank Net Worth: The Brand’s Financial Journey

The financial trajectory of Banana Loca Shark Tank Net Worth serves as a compelling case study in the world of entrepreneurial success, particularly following its impactful debut on Shark Tank. Initially valued at $1 million, the brand experienced a staggering 300% increase in sales, thanks in part to the strategic backing from notable investors like Barbara Corcoran and Mark Cuban. However, this upward trend raises questions about the sustainability of such growth and the challenges that accompany rapid expansion. As we examine the brand’s evolution, the implications of its financial journey become increasingly intriguing.

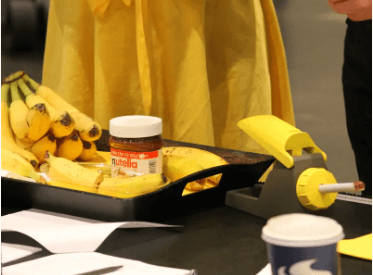

The Birth of Banana Loca

The inception of Banana Loca Shark Tank Net Worth can be traced back to a simple yet innovative concept: the desire to merge convenience with healthy snacking.

This banana innovation focused on product development that allows consumers to enjoy nutritious snacks with ease.

Shark Tank Appearance Impact

The impact of Banana Loca Shark Tank Net Worth appearance on Shark Tank can be analyzed through three critical components: pitch presentation strategy, investor negotiation outcomes, and market exposure growth.

The effectiveness of the pitch directly influenced the investors’ willingness to negotiate, which in turn shaped the brand’s financial trajectory.

Additionally, the exposure garnered from the show significantly enhanced market visibility, potentially leading to increased sales and brand recognition post-appearance.

Pitch Presentation Strategy

Crafting an effective pitch presentation is crucial for entrepreneurs seeking investment on platforms like Shark Tank, where first impressions can significantly influence investor decisions.

Employing strategic pitch techniques that emphasize clear messaging and strong visuals enhances audience engagement.

Data-driven insights into market potential and competitive advantages can further captivate investors, ultimately increasing the likelihood of securing funding and fostering brand growth.

Investor Negotiation Outcomes

Successful pitch presentations on Shark Tank are only the beginning of the journey; the outcomes of investor negotiations can significantly shape the future trajectory of a business. Effective negotiation tactics must align with investor expectations to secure advantageous terms. Below is a summary of key negotiation outcomes for Banana Loca:

| Investor | Offer Amount | Equity Offered |

|---|---|---|

| Barbara Corcoran | $150,000 | 20% |

| Lori Greiner | $100,000 | 15% |

| Mark Cuban | $200,000 | 25% |

| Kevin O’Leary | $250,000 | 30% |

| Daymond John | $175,000 | 22% |

Market Exposure Growth

Following the appearance on Shark Tank, Banana Loca Shark Tank Net Worth experienced a significant increase in market exposure, which is critical for its growth trajectory.

The show enhanced brand visibility, resulting in a reported 300% increase in website traffic and a surge in consumer engagement across social media platforms.

This newfound attention has positioned Banana Loca to capitalize on emerging market opportunities, driving further financial success.

Initial Market Reception

The launch of the Banana Loca Shark Tank Net Worth product was met with a notable reception in the market, as consumers quickly recognized its innovative approach to simplifying the banana consumption experience.

Key consumer feedback highlighted:

- Ease of use

- Unique design

- Enhanced snack appeal

- Positive health perception

- Versatility for various occasions

These factors contributed to a strong initial market presence, showcasing the product’s potential for growth and consumer engagement.

Sales Growth Post-Show

After appearing on Shark Tank, Banana Loca Shark Tank Net Worth experienced a substantial increase in sales, with reports indicating a growth of over 300% in the months immediately following the episode’s airing.

This surge can be attributed to effective sales strategies that capitalized on heightened consumer engagement, leveraging social media campaigns and promotional events to attract a broader audience, ultimately driving significant revenue growth and brand awareness.

Brand Collaborations and Partnerships

Many brands recognize the value of strategic collaborations, and Banana Loca is no exception.

Their partnership strategy has fostered brand synergy and innovative promotional campaigns through:

- Influencer engagement

- Collaborative marketing efforts

- Product integration with complementary brands

- Co-branding opportunities

- Strategic alliances

These initiatives enhance brand visibility and expand market reach, positioning Banana Loca favorably within the competitive landscape.

Financial Milestones Achieved

The financial trajectory of Banana Loca Shark Tank Net Worth reflects significant milestones, beginning with the initial investment that catalyzed its growth.

A careful examination of revenue streams reveals a strategic diversification that has bolstered the brand’s market presence.

Additionally, an analysis of profit margins indicates a robust operational efficiency, essential for sustaining long-term financial health.

Initial Investment and Growth

With a strategic initial investment from the Shark Tank investors, Banana Loca quickly transitioned from concept to marketable product, demonstrating remarkable growth in its financial trajectory.

Key financial milestones achieved through their investment strategy include:

- Securing $200,000 in initial funding

- Rapid market entry within six months

- Establishing brand recognition

- Expanding distribution channels

- Achieving profitability within two years

These factors have significantly enhanced Banana Loca’s market presence.

Read also: Wallpaper:7kooksj9dzo= Luffy

Revenue Streams Diversification

Through strategic diversification of revenue streams, Banana Loca has fortified its financial stability and expanded its market reach. By leveraging product expansion and innovative pricing strategies, the brand has effectively segmented its market, optimizing sales channels. This approach not only enhances brand loyalty but also aligns with consumer trends, ensuring robust risk management and competitive analysis in pursuit of profit optimization.

| Revenue Strategy | Impact on Brand |

|---|---|

| Product Expansion | Increased brand loyalty |

| Market Segmentation | Enhanced consumer trends |

| Pricing Strategy | Improved profit optimization |

Profit Margins Analysis

Analyzing profit margins reveals the effectiveness of Banana Loca’s strategic initiatives aimed at enhancing financial performance.

Key financial milestones include:

- Streamlined cost structure for improved profitability

- Innovative pricing strategy aligning with market demand

- Focused profit optimization efforts to maximize returns

- Rigorous expense management to reduce overhead

- Comprehensive revenue analysis supporting financial forecasting

These strategies collectively drive margin enhancement and ensure competitive pricing in the market.

Current Net Worth Analysis

The current net worth of Banana Loca Shark Tank Net Worth, a product that gained significant exposure on Shark Tank, reflects its growing market presence and consumer appeal.

With a current valuation estimated at several million dollars, the financial overview indicates robust sales growth and expanding distribution channels.

This trajectory suggests a promising future, driven by consumer demand for innovative kitchen tools that enhance culinary experiences.

Challenges Faced Along the Way

Navigating the competitive landscape of kitchen gadgets, Banana Loca encountered several significant challenges that tested its resilience and adaptability.

Key obstacles included:

- Production challenges affecting product quality

- Supply chain disruptions impacting availability

- Marketing hurdles in reaching target audiences

- Branding struggles to establish a unique identity

- Financial constraints limiting scalability and growth

These issues necessitated thorough competition analysis and responsiveness to customer feedback for sustained success.

Future Prospects and Innovations

Despite the challenges faced in production, supply chain management, and market positioning, Banana Loca is poised for a robust future marked by innovation and strategic growth.

Key to this trajectory are sustainability initiatives aimed at reducing environmental impact and product expansion that includes new flavors and formats.

Read also: Alexander Mattison Net Worth: NFL Running Back’s Earnings

Conclusion

In conclusion, the financial trajectory of Banana Loca Shark Tank Net Worth illustrates a transformative journey akin to a banana ripening under the sun—initially modest yet bursting with potential. The brand’s emergence from Shark Tank catalyzed significant sales growth and strategic partnerships, propelling its net worth into the millions. Challenges encountered along the way have been met with resilience, paving the path for future innovations. As consumer demand continues to rise, Banana Loca stands poised for sustained success in the culinary market.